A central focus of financial planning is to help people and their families to grow wealth and to make their income and savings last a lifetime.

If this income stops due to illness or injury, it is a severe shock to the system adding huge financial pressures at a very difficult time.

The aim of this article is to look at some of the State benefits that play an important role in maintaining a basic level of income for those unable to work due to illness or injury.

What is Illness Benefit?

Illness benefit is a weekly social welfare payment that you may get if incapable of work due to illness.

How do you qualify?

To qualify for illness benefit you must:

1. Be under State Pension Age (66 years)

2. Be medically certified as unfit for work by a medical doctor (GP)

3. Have sufficient PRSI contributions (further detail via Gov.ie)

4. Apply within 6 weeks of becoming ill

Who qualifies for State Illness Benefit?

Those paying PRSI at class A, E, H and P qualify for State Illness benefit.

This incorporates the vast majority of employees in Ireland between the ages of 16 and 66.

How much State Illness Benefit will I receive?

Usually, State illness benefit is not paid for the first 5 days of illness as this period is covered by the Statutory Sick Pay scheme paid by your employer.

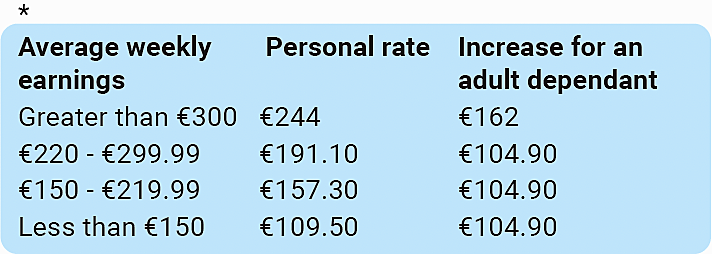

After this period Illness benefit begins and is based on average weekly earnings:

Illness benefit is payable for a maximum of 2 years, transitioning to invalidity pension after this period if ill or unlikely to be able to return to work.

What about the farming community?

Farming is an attritional pursuit built on hard physical work and long-term planning, but what supports are there for the farmer if they are unable to work due to illness or injury?

Like all self-employed people farmers that pay class S PRSI are not eligible for short term benefits such as illness benefit.

The benefit that they will be entitled to is the invalidity pension.

The bar to pass for invalidity pension is higher than illness benefit and the lead in time is far longer at 12 months.

You must meet the PRSI rules and be unable to work because of an illness or disability.

To meet the medical rules, you must:

• Have been incapable of work for at least 12 months and be likely to be incapable of work for at least another 12 months

Or

• Be permanently incapable of work

What is the rate of Invalidity Pension?

The weekly rate of invalidity pension is as follows:*

What action should be taken by workers?

A good financial planner will help you understand the value and importance of your income and to implement strategies to mitigate the risk of this income stopping by way of Income Protection or Specified Illness cover.

The State supports offer a basic level of income replacement but will not cover the cost of modern life for the vast majority of people.

Do not outsource your planning to State benefits, take control and prepare for the unexpected by protecting your income to a level sufficient to your own personal situation.

*Sources: www.citizensinformation.ie/en/employment/employment-rights-and-conditions/leave-and-holidays/sickleave- and-sick-pay/#2473e9 www.citizensinformation.ie/en/social-welfare/irish-social-welfare-system/social-insurance-prsi/social-insurance- classes/ communitylawandmediation.ie/sw/illness-benefit/ citizensinformation.ie/en/social-welfare/disability-and-illness/invalidity-pension/ www.citizensinformation.ie/en/social-welfare/disability-and-illness/illness-benefit/