‘Every morning I did a deal with myself that I wouldn't kill myself that day – I would do it tomorrow, that's how I kept going.'

‘EVERY morning I did a deal with myself that I wouldn’t kill myself that day – I would do it tomorrow, that’s how I kept going.’

Those stark words from farmer Seamus Sherlock outlined his way of dealing with the threat of losing his home to the banks, in 2012.

Speaking at a meeting held in Skibbereen last week on rural isolation organised by Lisheens House suicide prevention charity and An Garda Siochana, Mr Sherlock gave a stark warning to the audience of largely farmers: ‘The worst is yet to come.’

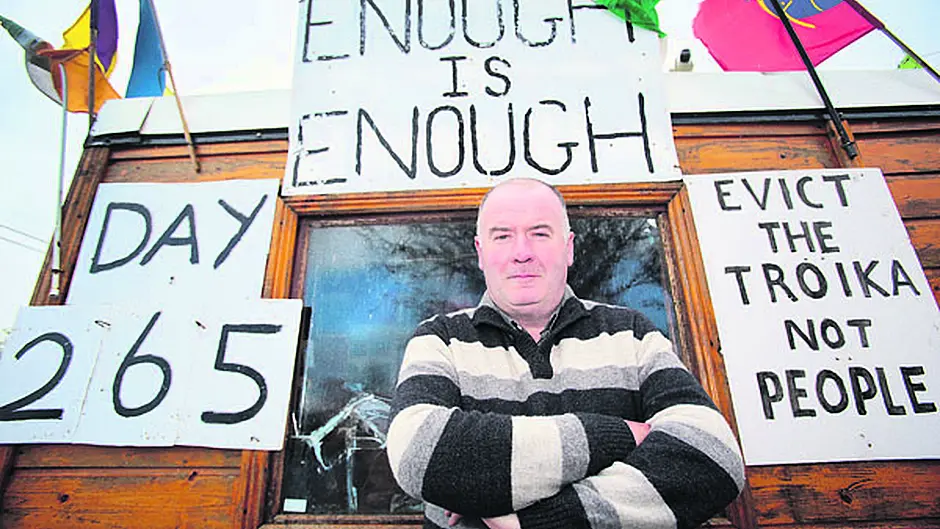

Mr Sherlock hit the headlines in 2012 when he barricaded himself into his farm after he was threatened with eviction by Bank of Scotland. He eventually made a deal with the bank, but only after his high-profile case garnered support from hundreds of members of the public who travelled to stand with him for several months.

Opening the meeting in Skibbereen, Clare-based Garda Edel Burke, who has been organising similar meetings around the country, spoke of the many incidents of rural isolation which led her to start a campaign to reach out to the rural communities.

She spoke movingly of one farmer who injured himself with a mower and crawled to his front door when he bled to death alone, because there was nobody there to help him.

She said she was delighted to see Lisheens House now reaching out to rural communities with its plan, to be launched this autumn, of ‘friendly phone calls’ and support meetings.

Telling his own story, Seamus Sherlock, who is also rural development chairman of the ICSA (Irish Cattle and Sheep Farmers Association), recalled how he got his first panic attack the morning he got the letter from his bank saying he was being evicted ‘without further notice’. The separated father-of-five told the meeting that he had to gather his children around the kitchen table and tell them what was happening.

But, within a half hour, they had decided to put 30 bales of silage against the gates, and once the story made it to the media, people started to call with food and support. ‘All I wanted was the bank to restructure my debt, but they refused.’ He said he was never alone for one day that time – except Christmas Day – when he told people to go home to their families.

The matter was eventually sorted with a ‘20 second phonecall’ from the bank and, 18 months after he first fought them, he got his debt restructured.

‘I was angry that I didn’t even get the time to tell them how I felt,’ he said of the very brief call.

With all the support he had received, the Co Limerick farmer was most taken with the letters he got from pensioners reaching out. ‘I was proudest of the letters with fivers stuck to the corners from people who probably couldn’t even afford that,’ he said.

‘I have no letters after my name, but I have been to hell and back,’ he told the meeting, but pointed out that he is still farming today, and if he can get through that time, then ‘we can get most people to stay farming’.

‘There were days when I decided I had had enough. But I had five children, and I said “no, they are worth more than that”. I did a deal every morning that I wouldn’t kill myself that day – that I would do it tomorrow.’

And eventually, things got better.

But, he says, the legacy of that time means he now gets up to 50 phone calls a week from other people – mostly farmers – in dire financial straits.

But he noted that it’s not just farmers – it’s teachers, even gardaí and more, who are experiencing isolation today.

He told the story of one man who rang him to say the bank was threatening to take his tractor and he couldn’t bear to show his face in the pub or mart again if they did.

‘I told him to hide it and we would think of something,’ said Seamus. ‘But at 6.30 that night, he took his own life. Over a 100hp New Holland tractor. And not because of a tractor, but because of the shame. That man died in vain, but I will never let that man’s memory die,’ he told the packed ballroom of the West Cork Hotel.

‘I have men crying on the phone telling me that they are useless or worthless. I tell them nobody is a failure, it is the system that is failing them.’

And he said that in all his years as a farmer, this has been the ‘worst winter ever’.

‘I am getting calls now from farmers, many who have no money left to buy feed,’ he said, adding that a lot of the credit union and bank loans have now run out, and the next month will be the real test for many.

Referring to the vulture funds that have taken on a lot of Irish bank loans, he predicted: ‘If you think a bank is bad, that is peanuts compared to what is coming down the line with these guys. I have met some of these fund managers, and they have no interest in family, or the family home, it’s all numbers to them.’

We cannot stand by and see them put half the country out onto the roads, he said. ‘They really are vultures. This country has to wake up. People are really struggling and a farmer will cure an animal before he will pay a doctor for himself. I could go on all night with the stories – but it’s the same old story.’

Mr Sherlock urged neighbours to just say ‘hello’ to each other more. ‘I think 99% of people are in better humour after the phone calls. They

just want people to understand.’

He said if people are feeling down, then there are plenty of places to go for help – Lisheens House in West Cork, or Pieta House, or the local gardaí or clergy. ‘Just ask for help, I know it’s difficult, but once you ask, half of it is gone off your shoulders.’

Also addressing the meeting on the night was Kathleen O’Leary of the Irish Farmers Journal who spoke of dealing with a challenging home life and how farmers should use the kitchen table as a place of security where people can talk freely about their problems and feelings.

Noreen Murphy, founder of Lisheens House, spoke of how her own family tragedy brought her to establish the charity.

She explained that when her husband, who was also from a farming background, took his own life after a short and unexpected battle with mental illness, she found herself very isolated and alone. She wanted to put supports in place so that no other family in West Cork would have to go through the same.

Independent Deputy Michael Collins, who had attended the meeting, later called on the government as the major shareholder in AIB to insure that AIB does not sell loans and mortgages to vulture funds.

‘The possibility of the sale of loans and mortgages by banks such as AIB and Permanent TSB to vulture funds such as Loan Star, Goldman Sachs and Cerberus is very concerning,’ he said.

However, he said the Minister for Finance Pascal Donohoe had stated the sales by AIB ‘were a matter for the board of AIB’.