If you are caring for someone, you may be entitled to a number of payments and supports to help you care for them.

This includes tax relief and getting leave from work.

You can get Carer’s Benefit if you leave work or reduce your hours to care for a person who needs full-time care.

You must be under 66 and have enough PRSI contributions.

You can get Carer’s Benefit for two years (104 weeks) for each person that you are caring for.

You can take the 104 weeks all together or in separate periods adding up to a total of 104 weeks.

Carer’s Allowance is a weekly social welfare payment to people who provide full-time care to someone because of their age, disability or illness (including mental illness)

To qualify for the payment, your income must be below a certain amount as it is means tested.

If you care for two or more people, your rate of Carer’s Allowance is increased by 50% (maximum) each week.

If you get another social welfare payment, you may get half-rate Carer’s Allowance

If you are a carer aged 16 or over providing full-time care for at least six months of the year, you may be able to get the annual Carer’s Support Grant.

The grant is paid automatically to people getting Carer’s Allowance, Carer’s Benefit or Domiciliary Care Allowance

If you don’t get one of these payments, you may still qualify for the grant if you meet certain criteria.

The Carer’s Support Grant is not means-tested.

Working or studying while caring for somebody

You can work (as an employee or in self-employment) or take part in an education or training course for up to 18.5 hours a week and keep your carer’s payment. Income earned may be taken into account for Carer’s Allowance.

The maximum amount you can earn and qualify for Carer’s Benefit is €450 a week after tax. From July 2025, this will increase to €625.

You can apply for carer’s leave if you are caring for somebody who needs full-time care and attention. You can take a minimum of 13 weeks and a maximum of 104 weeks of carer’s leave. Carer’s leave is unpaid but your job is kept open until you return. However, you can work for up to 18.5 hours while on carer’s leave, as long as you earn less than €625 a week (from July 2025).

Means test for Carers Allowance

Carer’s Allowance is a means-tested payment. In a means test, the Department of Social Protection (DSP) looks at all your sources of income. They also look at your spouse, civil partner, or cohabitant’s income. To qualify, your combined weekly income must be below a certain amount. They also look at your capital, this includes your savings, investments, shares, and any property you have (but not your own home). The first €50,000 of your capital does not affect your Carer’s Allowance payment. If you are a couple, your combined capital is divided by 2 and the €50,000 disregard is applied to this amount.

From July 2025, the Carer’s Allowance income disregard will increase to €625 for a single person and €1,250 for a couple.

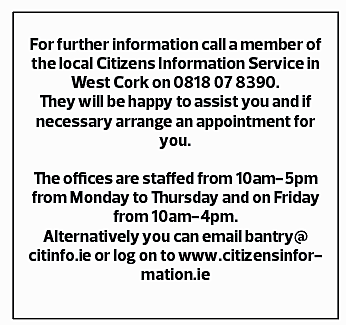

For more detailed information and assistance in relation to how the means test works, you should contact your local Citizens Information Centre.

Tax reliefs and credits for carers

There are tax reliefs and credits you may be able to claim if you are caring for someone. These include the Home Carer Tax Credit, the Incapacitated Child Tax Credit and the Dependent Relative Tax Credit. There is also tax relief for employing a carer if they are caring for you, your family member , spouse or civil partner who is totally incapacitated or your relative, or a relative of your spouse or civil partner who is totally incapacitated. You can employ the carer directly or you can use an agency that employs carers.

Keeping your social insurance record up to date

It is important to keep your social insurance record up to date for your State Pension Contributory entitlement. The Homemaker’s Scheme and the HomeCaring Periods Scheme help carers qualify for a higher rate of State Pension (Contributory) when they reach pension age.

If you have been a full-time carer for at least 20 years (1,040 weeks), you can get Long-Term Carers Contributions to help you qualify for the State Pension (Contributory).

If you give up work to care for someone and get Carer’s Allowance or Carer’s Benefit, you will be automatically awarded credit contributions. If you take unpaid statutory carer’s leave from work and do not get Carer’s Allowance or Carer’s Benefit, you can still be awarded credits for up to 104 weeks. Your employer must complete an application for carer’s leave ‘credits’ when you return to work. Contact your local Citizens Information Service for more information.

Respite Care

Respite care is when you can take a break from caring, and the person you care for is looked after by someone else. It can be covered by family members or an organisation so you can take a short break, a holiday or a rest. Respite care can be for carers of older people or people with different disabilities. Respite care is organised through your public health nurse or family doctor (GP).